Democrats are ready to raise taxes. They want more revenue, in part to fund an out-of-this-world amount of new spending. Some simply want to soak the rich, as Rep. Alexandria Ocasio-Cortez, D-N.Y., plainly signaled at the Met Gala by wearing a white dress with “TAX THE RICH” scrawled across it in red paint. While the public may be more receptive to the idea because of concerns over high budget deficits, let’s not be naive — many voters believe that these tax hikes won’t hit them. There’s so much wrong about this assumption.

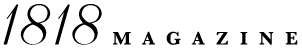

Writing for The Dispatch, the Manhattan Institute’s Brian Riedl documents President Joe Biden’s spending plan, which would expand federal government spending by $11 trillion over the next decade. This spending would help fund a cradle-to-grave new world in which government is omnipresent in our lives. The spending would increase family assistance by $550 billion. Another $700 billion would be wasted on counterproductive “Buy America” provisions. Expansion of the Affordable Care Act would cost another $1.4 trillion; some $2 trillion would go to a Green New Deal; K-12 schools would get more money. All of this is on top of the $6.6 trillion spent on COVID-19 relief.

Biden would partially pay for this $11 trillion with $3.6 trillion from higher taxes. As Riedl explains, “it would represent the largest permanent tax increase since World War II.” Even if the president got the revenue he hopes to collect with these tax hikes — which won’t happen once people start moving their capital around to avoid the oppressive tax burden — it would only cover a third of the new spending. Meanwhile, the House Democrats have their own $2.2 trillion tax plan, which covers even less of the new spending.

Many Americans may not care if they believe the spending could benefit them and other people will shoulder the tax bill, but that’s wishful thinking. They may not be the ones cutting a bigger check to the IRS, but many of them will shoulder some of the economic burden of the tax hikes through lower wages and higher prices.

Also, while many taxpayers may end up with more money in their pockets for a while, that won’t last. There simply aren’t enough rich people to pay for all the new spending. Collectively, the rich don’t even have enough wealth to pay for the kind of cradle-to-grave government that Democrats dream of. It’s only a matter of time before the politicians selling the dream of cost-free big government realize they need to raise taxes on ordinary Americans.

Just look at my native country of France for how it will be done. Pre-COVID-19, France’s revenue per GDP was 45.4%. It wasn’t simply raised on the backs of the rich. In fact, France raises most of its revenue through the Value Added Tax, social insurance, property tax and payroll. Those taxes are regressive as they consume a larger share of low- and middle-income earners’ income and have fewer effects on high-income earners. Add to these some 214 taxes and duties, along with an extremely high gasoline tax, and you end up with an oppressively burdensome tax system for everyone, even the poor.

By contrast, and contrary to Ocasio-Cortez’s belief, the U.S. federal income tax is unusually progressive because it raises most of its revenue from the income tax, which some 61% of households don’t pay. In other words, the bulk of federal taxes is already paid by higher income taxpayers, leaving other income groups particularly vulnerable to future higher taxes.

Don’t think I’m saying that if the Democrats get it wrong, the Republicans must get it right. They don’t. GOPers say they prefer lower taxes, but they do nothing to restrain spending. I saw evidence of this during the presidencies of Donald Trump and George W. Bush. My colleague Matt Mitchell, along with our former colleague Andrea O’Sullivan, wrote a great paper documenting what’s wrong with this approach. They explain, “Cutting taxes allows policymakers to give voters something they want, while appearing to rein in the size of government. But this is a temporary illusion unless the tax cuts are combined with necessary reductions in spending — a far more difficult but also the more important task.”

With few exceptions, nobody seems ready to tell the American people how far taxes will have to rise to satisfy Washington’s gluttony for spending. Unfortunately, that’s a lesson they will learn the hard way, and perhaps sooner than later.

Veronique de Rugy is a senior research fellow at the Mercatus Center at George Mason University. To find out more about Veronique de Rugy and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate webpage at www.creators.com.